Home

Hourly To Salary Calculator With Taxes . Fica contributions are shared between the employee and the employer. Using this formula, we can calculate the following annual.

How To Calculate Payroll For Employees from fitsmallbusiness.com The exact tax rate is specific to your business and may change each year. Fica contributions are shared between the employee and the employer. Follow the instructions below to convert hourly to annual income and determine your salary on a yearly basis. Take, for example, a salaried worker who earns an annual gross salary of $ 45,000 for 40 hours a week and has worked 52 weeks during the year. The latest budget information from april 2021 is used to show you exactly what you need to know.

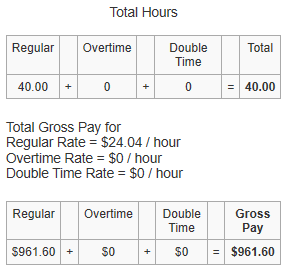

If you work a 2,000 hour work year then divide your annual earnings by 2,000 to figure out your hourly wage. Employees pay 1.45% from their paychecks and employers are responsible for the remaining 1.45%. Calculate your take home pay from hourly wage or salary. If you work a 2,000 hour work year then divide your annual earnings by 2,000 to figure out your hourly wage. This texas hourly paycheck calculator is perfect for those who are paid on an hourly basis. Use this calculator to quickly estimate how much tax you will need to pay on your income. This salary calculator can be used to estimate your annual salary equivalent based on the wage or rate you are paid per hour.

Source: calculator.me You may also want to convert an annual salary to an hourly wage. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. Overview of new york taxes new york state has a progressive income tax system with rates ranging from 4% to 8.82% depending on taxpayers' income level and filing status.

($5000 per month * 12 / 52 weeks) / 40 hours per week = $28.85. Take, for example, a salaried worker who earns an annual gross salary of $ 45,000 for 40 hours a week and has worked 52 weeks during the year. ($5000 per month * 12 / 52 weeks) / 40 hours per week = $28.85.

6.2% of each of your paychecks is withheld for social security taxes and your employer contributes a further 6.2%. Hourly wage paycheckcalculator need to calculate paychecks for your 1099 workers? Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Source: www.paycheckcity.com Calculate your take home pay from hourly wage or salary. To try it out, just enter the employee details and select the hourly pay rate option. Hourly rates, weekly pay and bonuses are also catered for.

Employers then match those percentages so the total contributions are doubled. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Monthly wage to hourly wage. Annual salary to hourly wage. The latest budget information from april 2021 is used to show you exactly what you need to know.

Source: lh3.googleusercontent.com There is in depth information on how to estimate salary earnings per each period below the form. The latest budget information from april 2021 is used to show you exactly what you need to know. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

However, the 6.2% that you pay only applies to income up to the social security tax cap, which for 2021 is $142,800 (up from $137,700 in 2020). Your average tax rate is 22.2% and your marginal tax rate is 36.1%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Monthly wage to hourly wage. You also won't have to pay any local income taxes, regardless of which city you reside in. Hourly rates, weekly pay and bonuses are also catered for.

Source: www.portalprogramas.com For example, if an employee earns $1,500 per week, the individual's annual income would be 1,500 x 52 = $78,000. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. You also won't have to pay any local income taxes, regardless of which city you reside in.

Multiply 188 by a stated wage of $20 and you get $3,760. New zealand's best paye calculator. There is in depth information on how to estimate salary earnings per each period below the form.

For example, if an employee earns $1,500 per week, the individual's annual income would be 1,500 x 52 = $78,000. There is in depth information on how to estimate salary earnings per each period below the form. Employees pay 1.45% from their paychecks and employers are responsible for the remaining 1.45%.

Source: www.howtofire.com Annual salary to hourly wage. This salary calculator can be used to estimate your annual salary equivalent based on the wage or rate you are paid per hour. In 2019, the minimum tax rate is 0.36% and the maximum is 6.36%.

To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. The latest budget information from april 2021 is used to show you exactly what you need to know. Hourly daily weekly monthly annually.

Overview of new york taxes new york state has a progressive income tax system with rates ranging from 4% to 8.82% depending on taxpayers' income level and filing status. How much do you get paid:*. Employees pay 1.45% from their paychecks and employers are responsible for the remaining 1.45%.

Source: calculator-online.net However, the 6.2% that you pay only applies to income up to the social security tax cap, which for 2021 is $142,800 (up from $137,700 in 2020). This calculator is always up to date and conforms to official australian tax office rates and formulas. As an employer, you'll pay texas unemployment insurance (ui) on the first $9,000 of each employee's wages each year.

As an employer, you'll pay texas unemployment insurance (ui) on the first $9,000 of each employee's wages each year. Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Federal tax, state tax, medicare, as well as social security tax allowances, are all taken into account and are kept up to date with 2021/22 rates

Employees pay 1.45% from their paychecks and employers are responsible for the remaining 1.45%. Weekly paycheck to hourly rate. The exact tax rate is specific to your business and may change each year.

Thank you for reading about Hourly To Salary Calculator With Taxes , I hope this article is useful. For more useful information visit https://labaulecouverture.com/