Home

State Farm Term Life Insurance For Seniors . Apply online in minutes today! The state farm � select term life insurance policies offer coverage for periods of 10, 20, or 30 years.

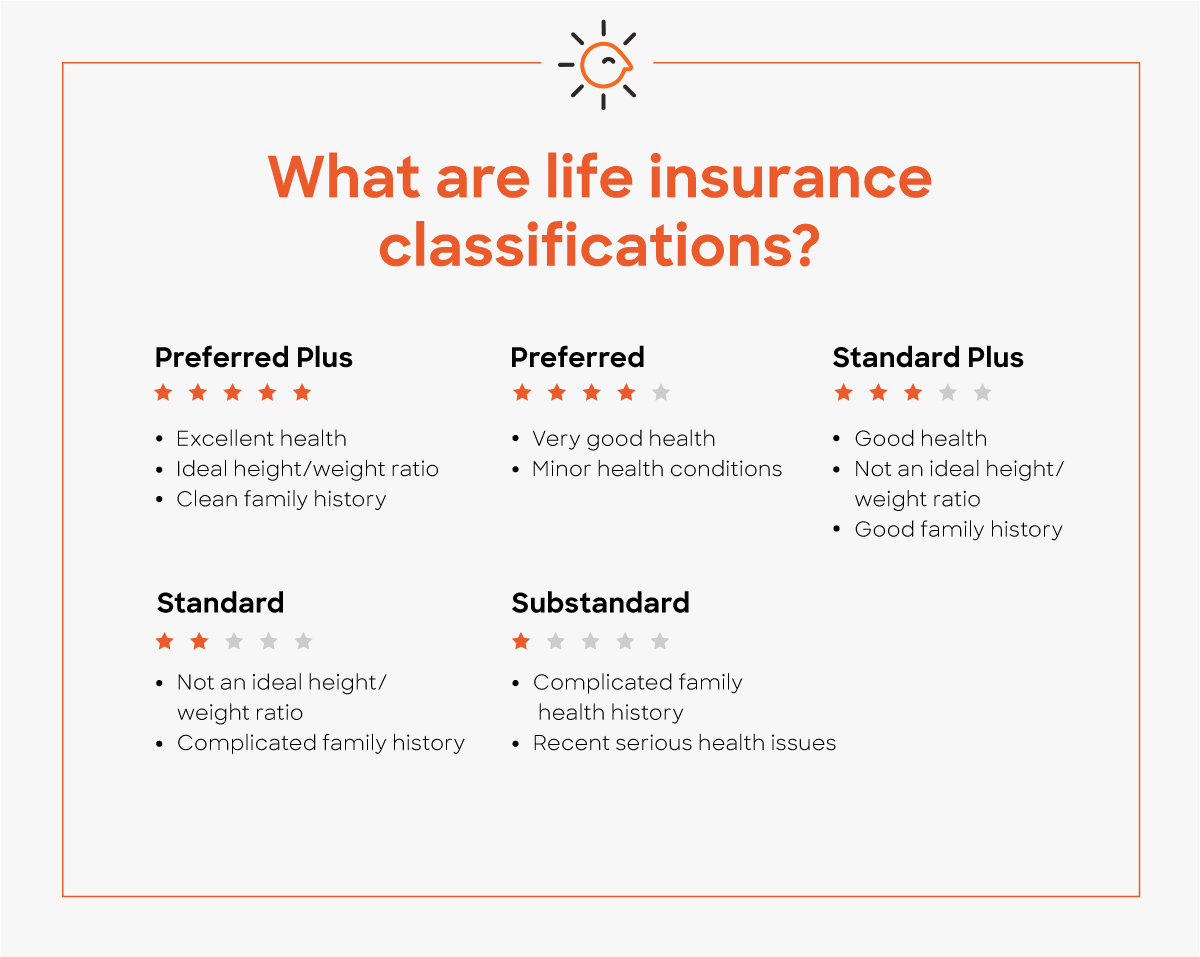

What Are Life Insurance Classifications Policygenius from images.ctfassets.net State farm offers term life policies lasting 10, 15, 20 or 30 years, with coverage amounts between $50,000 and $3 million. Term life insurance is the best option for most people, including seniors, because it provides the most coverage at the lowest price ? especially if you're in good health. Get a free term life quote with state farm today! Whole life insurance is a type of irreversible life insurance created to provide life time protection. It also sells specialized term policies that may suit your needs.

The state farm � select term life insurance policies offer coverage for periods of 10, 20, or 30 years. Whether you're looking for the affordability of term insurance or the lifelong protection and cash value of permanent insurance ? or a combination of both ? state farm life insurance company and state farm life and accident assurance company (licensed in ny and wi) have options to fit your needs and budget. Affordable rates & coverage you can count on. State farm is one of our favorite providers for term life insurance thanks to its diverse offerings. Get a free term life quote with state farm today! Term life insurance is available through age 80, although. The owner can access the cash in the cash worth by withdrawing loan, borrowing the cash money value, or surrendering the policy as well as obtaining the surrender worth.

Source: i.pinimg.com With pure term life insurance, there is no cash payout at the end of the policy term, although state farm has an alternative, discussed below. Premiums are guaranteed level for the length of your term, then increase annually until age 95. These articles were tagged with 'senior living' in the newsroom of state farm For seniors who want a simple life insurance solution that provides basic coverage, state farm also offers final expense insurance with a $10,000 policy designed to provide for burial expenses and.

State farm offers term life policies lasting 10, 15, 20 or 30 years, with coverage amounts between $50,000 and $3 million. The state farm � select term life insurance policies offer coverage for periods of 10, 20, or 30 years. State farm whole life insurance policies offer level premiums and life insurance protection for as long as you live, provided that premiums are paid as required to keep the policy in force. Affordable rates & coverage you can count on.

Term life insurance for seniors term life insurance is a simple product that pays out a specified death benefit to the policy's beneficiaries if the insured dies within a given timeframe. You choose the length of time, depending on how long you need the coverage. The exact price is determined based on gender, age, state of residence, health, and the amount of coverage you want. You can convert any state farm term life insurance coverage to permanent coverage, regardless of your health status.

Source: quotesbae.com Term life insurance for seniors term life insurance is a simple product that pays out a specified death benefit to the policy's beneficiaries if the insured dies within a given timeframe. Apply online in minutes today! Policies can be paid with a single premium, premiums payable to 100, or premiums payable up to a limited number of years. State farm � life insurance for all that matters to you state farm life insurance company (not licensed in ma, ny or wi) or state farm life and accident assurance company (licensed in ny and wi) can help you find coverage that's right for you and your loved ones.

It never goes below 20% of the original benefit. State farm offers term life policies lasting 10, 15, 20 or 30 years, with coverage amounts between $50,000 and $3 million. Get a quote for term life insurance Apply online in minutes today!

Conversion options will vary by state and with some term policy types by age. Whole life insurance is a type of irreversible life insurance created to provide life time protection. The exact price is determined based on gender, age, state of residence, health, and the amount of coverage you want. For the first 5 years, the death benefit remains level and begins to decline annually as your mortgage is reduced.

Source: www.jdpower.com The policies are also convertible to. The exact price is determined based on gender, age, state of residence, health, and the amount of coverage you want. Premiums are guaranteed level for the length of your term, then increase annually until age 95. Term life insurance is the best option for most people, including seniors, because it provides the most coverage at the lowest price ? especially if you're in good health.

Term life insurance for seniors over 70 generally becomes more limited than the previous age groups. State farm sells term life, whole life and universal life insurance policies to individuals. Policies can be paid with a single premium, premiums payable to 100, or premiums payable up to a limited number of years. Select term life insurance with our select term life insurance, you can choose between 10, 20, or 30 years of coverage and a guaranteed benefit.

Apply online in minutes today! State farm whole life insurance policies offer level premiums and life insurance protection for as long as you live, provided that premiums are paid as required to keep the policy in force. You can convert any state farm term life insurance coverage to permanent coverage, regardless of your health status. Most state farm � term policies can be converted without evidence of insurability.

Source: cdn.aarp.net This means that during the level term period, and before age 75, you are able to convert regardless of your health to a permanent policy, such as whole life or universal life. If you're looking for a company with a great reputation, state farm ranked first out of 23 companies for overall customer satisfaction in j.d. Term life insurance for seniors over 70 generally becomes more limited than the previous age groups. State farm term life insurance term insurance is the least expensive life insurance you can buy and coverage continues until the policy term lapses, usually from 10 to 30 years, as long as you pay premiums.

These include a return of premium (rop) policy that reimburses you for any premiums paid if you outlive your term, and a mortgage life insurance policy that. State farm whole life insurance policies offer level premiums and life insurance protection for as long as you live, provided that premiums are paid as required to keep the policy in force. However, there are a few companies out there that offer term life insurance policies for people that cover up to age 85 and 95. Get a free term life quote with state farm today!

The state farm � select term life insurance policies offer coverage for periods of 10, 20, or 30 years. Or, you can convert your policy to permanent life insurance. Term life insurance is the best option for most people, including seniors, because it provides the most coverage at the lowest price ? especially if you're in good health. Our top pick for life insurance for seniors, mutual of omaha, offers term, whole, and universal life insurance with flexible policy provisions.

Source: www.bankrate.com You can convert any state farm term life insurance coverage to permanent coverage, regardless of your health status. Most term life insurance policies only extend to age 75, with the ability to convert to a whole life policy at age 75. All of state farm's term products can be converted to permanent coverage, regardless of changes to your. Whole life insurance is a type of irreversible life insurance created to provide life time protection.

Whether you're looking for the affordability of term insurance or the lifelong protection and cash value of permanent insurance ? or a combination of both ? state farm life insurance company and state farm life and accident assurance company (licensed in ny and wi) have options to fit your needs and budget. Most term life insurance policies only extend to age 75, with the ability to convert to a whole life policy at age 75. If you're looking for a company with a great reputation, state farm ranked first out of 23 companies for overall customer satisfaction in j.d. This includes term life, whole life and universal life insurance.

As a whole life insurance policy, it accumulates cash value with the potential to earn dividends based on state farm's profits. According to new york life, most term life insurance policies after the age of 60 are often renewed every five or ten years.rarely will seniors find policies that last more than ten years. These include a return of premium (rop) policy that reimburses you for any premiums paid if you outlive your term, and a mortgage life insurance policy that. Customers can choose from three different term structures depending on their needs:

Thank you for reading about State Farm Term Life Insurance For Seniors , I hope this article is useful. For more useful information visit https://jdvintagecars.com/